written by Brian Frederick, CFP®, CIMA® & Trevor Marston

What We’re Seeing

“The stock market is a device to transfer money from the impatient to the patient.”

– Warren Buffett

It’s an age-old problem. People always keep trying to look over the horizon and try to find greener pastures. The grass is always greener on the other side, or so they say. Maybe it has something to do with our biological need to explore and learn. Down here, you say, it’s not so good. My grass is turning brown. Or maybe you feel like it’s looked like straw for ages now. However, sometimes we get so used to looking at the same patch of grass, looking at it so deeply and intensely, scrutinizing every last blade and its length, that we become dissatisfied with it. We compare it to an ideal patch of grass. It’s perfectly manicured and soft, with the sun shining on it. Of course, that patch exists only in our heads. We start to reflect that ideal outside ourselves into the world. If it exists in my head, it has to exist somewhere, one might say. I bet it’s just over that hill.

What does this have to do with economics? Well, domestic economics feels a lot like that patch of grass sometimes. Take the US economy, for instance. On the heels of massive shocks with COVID, inflation, and myriad geopolitical conflicts around the world, we find ourselves amid a relatively strong economy in the US. That’s, of course, always relative. While the US economy seems well positioned to have weathered these storms much more in stride than other nations, if you asked people how the economy was going, they would give you widely varying opinions. Some positive, some in the middle, and some negative. Their value system outside of the economic or financial realm may have as much impact on their judgment as the economy itself. This shows up frequently in data points like “consumer sentiment.” This survey is classically split along partisan lines based on who is currently in the White House. If you look closely at the data, though, they say the same thing because shifts in that data are almost identical when they move. We call that “highly correlated.” That means that despite having widely differing base assumptions, possibly based on other factors, the data tells us that people still generally agree on which direction it’s going when things cause a shift in the data.

Now, the economy, much less the world, is far from perfect, but all things considered, our little patch of grass could be significantly more tan. Who knows, when we finally get over to that other patch of grass we’ve been fawning over, we may discover that the owner has covered it with Grass Paint (Yes, that’s a thing). That’s why we favor sticking to a process. A process can help you tune out the noise and assess the information you’re receiving more clearly. It provides a touchstone that you’re able to come back to and remind yourself that despite all the gyrations outside, you’re still putting one foot in front of the other and staying to the reality of your situation.

5 Major Takeaways

- Elections: Elections are always contentious, and invariably one side sometimes feels like the sky is falling. One side of the aisle felt that way in 2016, and the other in 2020, and that’s generally how things have been as long as this writer can remember. With the election season coming up, JP Morgan publishes an excellent piece that describes how elections have historically had minimal effect on stock market returns in the long run and debunks three other common myths about elections and the markets. Oftentimes, the underlying economy is much more impactful on how the market goes. [Link]

- Inflation: What do we even mean when we talk about inflation? It’s a hard question to answer. The Federal Reserve’s preferred measure is PCE, while the number that gets published most often is CPI-U. Each metric has a different weighting on each component, but the rate of inflation you feel may be nothing like the numbers reported. There’s now even a tool [Link] from UMass Boston that will help you calculate your own personal CPI. Inflation, much like many things in finance, can change based on your personal goals and lifestyle.

- Confident consumers: Consumer confidence and sentiment have ticked up recently, meaning, in general, people are slightly more optimistic about the overall economy. An interesting indicator, this data comes to us through a University of Michigan survey conducted every month. Historically, and especially in recent years, there has been a historically wide disparity along political lines in respondents. However, as confidence improves, that gap begins to narrow. [Link]

- World Strife: With the further escalation in the conflicts in the Middle East, proxy conflicts in the Red Sea, the ongoing war in Ukraine, and ongoing saber-rattling in the South China Sea, the phrase “may you live in interesting times” has lost some of its luster. Wellington Management provides an excellent and well-sourced (but more technical) commentary on how markets don’t always react like you’d expect in during periods of ongoing conflict. [Link]

- Anti-Trust: With renewed vigor, the United States is bringing anti-trust cases against some of the largest tech companies in America [Link]. While the case against Apple is just the latest, there are a number of other anti-trust cases that have been brought recently including against Amazon near the end of 2023 [Link] and Google in January of 2023 [Link].

One Big Number

36%1

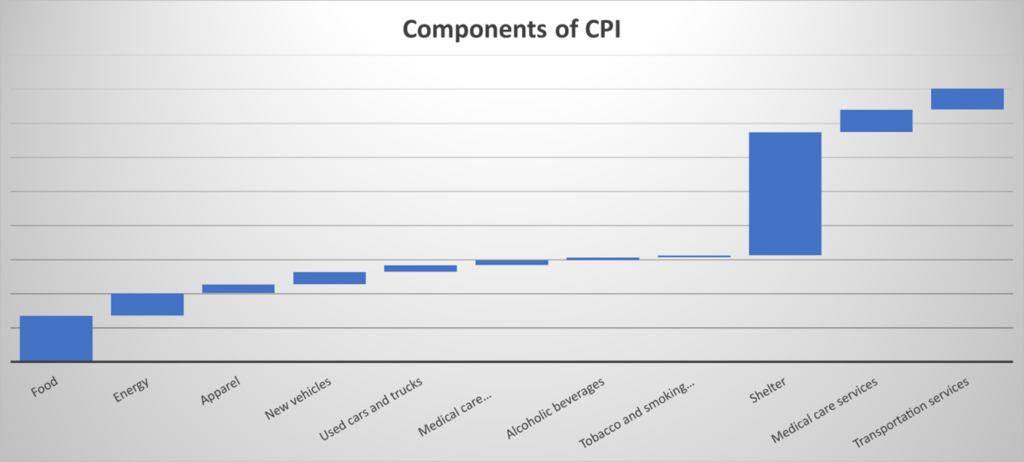

This number represents the weight of shelter prices in the CPI-U index. CPI-U is the number that people normally think of when they think of inflation. However, it might be interesting to note that CPI isn’t the measure that the Federal Reserve prefers to track inflation. One of the reasons the Fed prefers another metric, PCE, in place of CPI is the amount of weight that CPI places on shelter prices.

And One Big Chart

1

1

As you can see, shelter represents a pretty large chunk of that waterfall. Now underneath what the Bureau of Labor Statistics, the government body that produces these data points, calls “shelter” are several components (owner’s equivalent rent and rent of primary residences being the two largest). Both of those components are gathered through survey data that can sometimes have some delay in it [Link]. For these reasons and more we think that shelter inflation will continue to moderate.

1 Source: Bureau of Labor Statistics: https://www.bls.gov/news.release/cpi.t01.htm